Oktober, 2009

Archive for Oktober, 2009

Why this Blog?

Learn from the others! Working for some international companies in the past which made the step in the german market I made a lot of experience of dos and donts. In my daily business I see so many chances for optimisations that I’m wondering why nobody had the idea to bundle those things. Most of them are obvious and that’s what this blog is for. To bundle obvious things and make life easier. Of course you will find tons of know-how even figures if available on this blog also, so grab a glass of your favourite drink, lean back and enjoy this stuff! But you can be for sure that this blog will not show any informations which are company confidential I worked for. I just will rely on figures which are public!

Usage of credits cards in Germany

Working for some international companies in the past years it was always amazing which thoughts those companies had about the usage of credit cards in Germany. So if you are working in company which is thinking about to enter in the German market this article will open your eyes…

Before we dig deeper into the figures. It’s pretty interesting to see the overall credit card usage in Europe and especially in Germany:

source: © Deutsche Bundesbank 2009; Payment behaviour in Germany; calculations based on ECB data (2008)

bad times for credit cards:

It’s pretty facinating that all card payments (incl. debit cards and credit cards) in Germany made has a share of just of 7%! Regarding the EU it’s less than the half of the usage. It would be very interessting to know how the usage are in specific countries. If I find therefore some figures I will update this article asap.

Ok, now normally you would think, ok the Germans need more time to get used to the credit card. But this thought is unfortunetaley wrong. If you look at the figures you can see that in Germany credit card usage grew just by 24% from 5.3% to 7.0%. Ok, this is more in growth than in EU area excl. Germany which just grew by 15%. But if you have a look at the decrease from 7.1% to 7.0% of the usage in DE from 2005 to 2006 this could be a signal of an upcoming saturation in Germany. Thus 27% of Germans own a credit card, but just 33% of them or 8% had used their card in a one-week observation period.

Note: Of course we are talking here not only about online business. Those figures are for all payments made in DE, also incl. retail offline stores.

Cash payment overall of Germans has a share of 58% of all expentidure. Followed far behind by the girocard (approx. 26%), credit transfers (approx. 9%) and at the unlucky end credit card fights for roundabout 4%.

source: © Deutsche Bundesbank 2009; Payment behaviour in Germany

Can the credit card fight back in online business in Germany?

According to BITCOM private E-Commerce business generate a turnover of 46 billion Euro in 2006 in Germany. Gfk another market research company states the private online business in 2007 generated a turnover of just 17,2 billion Euros in Germany. The truth can be found somewhere in the middle… despite the figures varies very much for my taste…

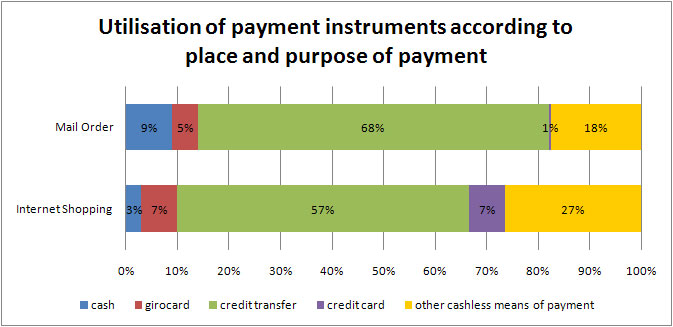

For the online business I will also consider the values of mail orders, because most mail orders do offer in the meantime the possibility of online shopping – at least the big ones do.

source: © Deutsche Bundesbank 2009; Payment behaviour in Germany

You’ve got the message? It’s unbelivable that just 7% of the online shoppers are paying with credit card. Even the most common widest spread (91% of Germans have at least one) direct debit card “girocard” in Germany is used by the Germans for online shopping! Another interesting result is that 57% of online shoppers and 68% of the mail order shoppers prefer to pay with the good old credit transfer.

Another interesting fact is that other alternative payment methods such as PayPal, Moneybrookers, etc. still are playing a very small role in the online business. But they are growing and have a huge potential to substitude a big portion of the current preferd credit transfer payment method – the credit card couldn’t do it yet, so let’s see if they are smart enough…

There are quite some reasons why Germans don’t really use their credit card much. First of all Germans are very carefully when they have to provide their data. And of course because of different fraud news in the press from big companies where personal data of customers had be stolen from hackers and other fraud issues of other big companies Germans’ see themselves confirmed not to give their personal data to online companies even if those companies are big and they have a trustable brand! Another reason could also be that Germans like to shop anonymous and also prefer to pay with cash.

So if you’re a foreign company thinking about to roll out in Germany you should at least offer one more payment mehtod than paying by credit card in Germany! Which those ones should be and how a smart combination of different payment methods can positivly influence the finishing of the payment funnel in your online shop, you will read next here…

posted in Online-Shops Oktober 7th, 2009